Estate Planning Lawyer Memphis TN

An estate planning lawyer in Memphis, TN whom families depend on from Patterson Bray understands that estate planning can be a sensitive topic since you are planning for what happens after you pass on. For many people, it is a complex topic, and it is often delayed until later on in life. There is a common misconception that estate planning is reserved only for the wealthy. What many people don’t know is that estate planning is a relevant topic for anyone with cash or assets. The purpose of an estate plan is to have your wishes respected and executed so that your loved ones and assets can be taken care of. A living trust is just one way you can preserve your values and assets after your passing. Whether your estate is big or small, you must write a living trust if you want your legacy protected and passed onto future generations of those you love the most. Rest assured that we have the compassion and experience needed to support you as you create an official living trust.

Estate Planning Lawyer Memphis TN

- ABOUT PATTERSON BRAY LAW FIRM

- PROLONGING LIFE

- PAIN RELIEF

- NO FURTHER RESUSCITATION ORDERS

- MEMPHIS ESTATE PLANNING LAW INFOGRAPHIC

- “LIVING” ESTATE PLAN DOCUMENTATION

- TIPS FOR MANAGING FAMILIAL CONFLICT

- COMMON MYTHS ABOUT ESTATE PLANNING

- QUESTIONS TO ASK AN ESTATE PLANNING LAWYER

- ESTATE PLANNING LAWYER MEMPHIS TN

- QUALITIES OF A GOOD ESTATE PLANNING LAWYER

- THE BASICS BEHIND A WILL

- QUICK TIPS ABOUT LAST WILL AND TESTAMENTS

- WILLS AND TRUSTS

- POWER OF ATTORNEYS

- LEGAL GUARDIANSHIPS

- ADVANCE DIRECTIVES AND DURABLE HEALTH CARE POWER OF ATTORNEYS

- ESTATE TAX PLANNING

- MEMPHIS ESTATE PLANNING LAW STATISTICS

- MEMPHIS ESTATE PLANNING LAW FAQS

- PATTERSON BRAY MEMPHIS ESTATE PLANNING LAWYER

- MEMPHIS ESTATE PLANNING LAWYER GOOGLE REVIEW

About Patterson Bray Law Firm

At Patterson Bray, an estate planning lawyer in Memphis, TN families trust has advised many clients who are working on their estate plans. The estate planning process can be tricky. There are a number of approaches to it, but what you decide to include in your estate plan is up to your particular values, interests, and whether or not there are loved ones that you intend to pass your assets along to. Whether you are just starting your first draft or need to update an old and outdated one, we can help ensure all your bases are covered. We can help you continually update your estate plan when necessary. Thinking about the future and how to best manage your estate after your passing is not always simple or clear. Making plans for after death is not really what you would call having a “good time” per se, however, the alternative would be risking your legacy by going through the hoops of probate court where the government has more of a say in handling your assets.

If your estate does end up in probate court because you lacked an estate plan, this means more stress and frustration for your loved ones who will already be struggling after your passing. Not having an estate plan established can lead to family conflicts or other third parties attempting to seize a part of your wealth or one or more of your assets. Hiring an estate planning lawyer in Memphis, TN that clients can confide in can help you achieve a sense of relief knowing that the distribution of your wealth is prepared for.

#1 Understand The Cons of Probate

Probate court entails establishing the validity of a written will, distributing assets, settling debts, and more. Most people want to avoid probate if possible, as they prefer not to have the court handle any element of their assets. This is understandable, since the court may handle your estate much differently than you would prefer. For example; when it comes to various assets that may be discussed and assessed when involving a loved one who is deceased, different court systems may come forth with different types of compensations, they may see some assets as less valuable than others, and more. These are some of the reasons why families may not entirely trust aspects pertaining to probate, within a court system.

Moreover, probate is often costly and frequently results in an immediate devaluing of the estate. This is because, in most circumstances, probate will cost the estate around 5% in expenses. Secondly, probate can postpone dependents or heirs from receiving funds in the estate for several years. This would especially cause issues with families that are looking to get an estate planning lawyer situation resolved in a quick manner. To avoid this issue, it is recommended that you have an estate plan so that your specified wishes can be carried out.

#2 Don’t Forget About Personal Items

Our lawyer may suggest that if you have a book collection, family heirlooms, a box of photographs, a journal, or other items that have sentimental value, do not forget about them in your estate plan. Our lawyers understand the value of personal items when it comes to estate planning. Thus, they should be some of the items that come first and foremost. We all have belongings that are of particular significance to our lives but may not look the same to another person. Listing these in your estate plan gives you the chance to think about what means the most to you. There may be certain individuals that you would like to pass your possessions. To make sure your possessions are taken care of, you may want to name people that you think would best appreciate them. This way they are not discarded and actually go to people who will value them as much as you do. The expensive and sentimental belongings and how you want them distributed must be clearly outlined, so there is no confusion.

#3 Figure Out Who You Want to Receive Assets

Most people choose their significant others, children, and other close family members as beneficiaries. As an estate planning lawyer in Memphis, TN clients trust may explain, it is common for people to list relatives that mean the most to them as beneficiaries of their assets. But, you can also include friends and charitable organizations if you’d like! This is often overlooked by many people working on their estate plans. If there are certain charities, organizations, or causes that are meaningful to you, make sure to make note of them in your plan. Think about how you want to organize your donations to those specified causes. Whether you have certain individuals or causes in mind, make sure to name and list each of them in your estate plan so no one is left off. Think about the people who would love getting something special of yours to remind them of you for years to come, after you have passed away.

#4 Make a List of Tangible and Intangible Assets

If you have an abundance of assets and belongings, then this stage may take some time. You want to write a list of all the assets you own, including tangible and intangible items. For instance, you need to include your vehicles, boats, homes, property, life insurance policies, stocks, bonds, jewelry, and anything else of value to you (whether monetarily or sentimental). What creating a list does, is it aids in assessing an organization. Thus, a family can better understand why some assets are tangible, why others are intangible, and how that relates to the process of estate planning as a whole. An example of tangible assets would be of books and gifts, in honoring a loved one. Meanwhile, intangible assets are those that focus on virtual assets, such as bank account funds. Overall, it is strongly recommended that you begin the estate planning process early, especially if you have a long list of assets that need to be listed. For certain items, it may take additional time to decide how you want them to be taken care of.

#5 Assign Assets to Your Beneficiaries

Once you have completed the first two steps, then you will move on to combining these lists. Use your list of beneficiaries to assign what assets you want them to have after you have passed away. Keep in mind that if you have certain people listed on your life insurance or other policies you may need to make changes, so everything matches. An estate planning lawyer Memphis, TN families, rely on can give you information about how to make edits to such policies if needed.

#6 Find Supportive Documentation

It would help if you found paperwork related to your assets, so the person distributing these things for you to beneficiaries doesn’t encounter road bumps. You want your plan to be as clear as possible to avoid confusion and prevent conflicts between different parties, such as family members. Gather documentation such as titles, stock certificates, policies, deeds, etc. You can share these with your lawyer at Patterson Bray, as he or she helps you finalize your living trust.

#7 Appoint a Successor Trustee

When you have a living trust, you need to name yourself as the trustee to continue to manage assets throughout your life. But then you must choose a successor trustee, who shall distribute assets to beneficiaries based on your wishes and pay debts upon your passing. This person should be someone that you trust to handle your affairs responsibly and without motivation for personal benefit.

If you are ready to begin writing your living trust or must make edits to a current version, then an estate planning lawyer from Patterson Bray can offer the guidance you need, so don’t delay in calling today!

When you would like to create an estate plan, you need the help of an estate planning lawyer Memphis, Tennessee residents can rely on from Patterson Bray. Preparing for a worst-case scenario is never something that you want to do, but failing to do it may hurt you and others. Your estate plan is something that you should not put off too long. Failing to get your wishes down in a legal document may leave those you love facing impossible choices.

A Memphis estate planning lawyer knows that a living will be a piece of your estate plan. It is a document that sets forth the medical interventions you want hospitals and doctors to make should you be unable to make decisions. Along with medical power of attorney, it provides a guide for the person you want to appoint to be in charge of your medical care during this time. Understanding what goes into a living will come in handy when it comes time to create one.

Avoiding Probate Pitfalls

Prolonging Life

The foundation of a living will is to let those around you know what kind of medical care you want after sustaining either a catastrophic injury or illness that leaves you unconscious. The most basic document alerts family and medical personnel about what measures you want taken to extend your life when you enter the end of life phase of care. Some of the medical procedures/measures in this section should include:

- Surgical intervention

- Use of a ventilator

- Blood or plasma transfusion

- Medication administration

- CPR

- Kidney dialysis

You may also want to consider the conditions under which you do and do not wish these life-prolonging actions taken. An estate planning lawyer in Memphis, TN can help you go over the options.

Pain Relief

If you have dealt with massive trauma or a prolonged and painful illness, you may want to forego life-prolonging care and enter palliative relief. This phase of end-of-life care deals with conditions that will not get better and maybe cause you great pain. The administration of pain medication does not do anything to lengthen your life so it will not go against anything you stated in the prior section. It will, however, help provide you comfort while your body naturally shuts down.

No Further Resuscitation Orders

One of the things that a hospital does is take every measure possible to resuscitate you if your heart should stop. This includes performing CPR or using electronic paddles to jump-start your heart. Should your health decline to the point that it will not improve, you may want to add a “Do Not Resuscitate” section in your living will. This section will alert your power of attorney and the hospital that you do not desire to have these life-saving measures undertaken.

Speak With an Estate Planning Lawyer in Memphis, TN Now!

Thinking about the end of your life is not a pleasant prospect. However, speaking with an estate planning lawyer Memphis, TN residents rely on from Patterson Bray about preparing yourself and your family for it may make it easier for your loved ones to deal with it when the time comes.

Memphis Estate Planning Law Infographic

“Living” Estate Plan Documentation

It has often been said that estate planning documents are living documents. What does this mean? With very few exceptions, you can alter or modify any of your estate planning documents as your life experience, circumstances, and preferences change. As a result, you can always turn to a lawyer community members trust when needs and preferences change over time. As your life evolves, we can help your estate planning documentation to evolve accordingly.

What documents do you need to have in place at all times?

At a minimum, you’ll want to speak with our team about creating a living trust and will, a durable power of attorney, a healthcare power of attorney, an advance healthcare directive, and (if you are a parent of minor children or incapacitated adult dependents) guardianship designations. Whereas a will and/or living trust will help ensure that your assets are distributed according to your wishes, financial and medical powers of attorney will allow other trusted adults to make decisions on your behalf if you become incapacitated.

By contrast, an advanced healthcare directive will tell your medical care team your medically-related wishes if you are hurt or ill to such a degree that you cannot articulate them on your own.

Legal Assistance Is Available

Every adult needs to create a comprehensive estate plan, as not all estate-related matters may be lawfully enforced simply by having a will and/or living trust in place. If you do not yet have a comprehensive estate plan in place or need to update or otherwise modify your existing estate plan, please schedule a consultation with us at Patterson Bray. None of us knows how long we will have until our estate plans become urgent matters for our loved ones to grapple with.

To better ensure that your wishes are clearly articulated and legally enforceable, please connect with an estate planning lawyer in Memphis, TN families trust at our law firm Patterson Bray today.

Tips for Managing Familial Conflict

One of the biggest concerns and one of the primary reasons for creating an estate plan is mitigating the risk of familial conflict should you become incapacitated or pass away. The harsh reality is that the tragic and unexpected can occur at any moment, and you must be as prepared as possible. Familial conflict can be devastating to relationships within the family; it stands to put your estate at risk when you ultimately pass away. When loved ones pass away, emotions run high. As such, there are times when conflict can be more likely if one is not careful. This is true when it comes to estate plans because if emotions are running high, there can be conflict and arguments that occur if there is not a proper understanding of an estate plan, how it works, or who gets to keep various assets, when it comes to estate plans, and more. Safeguarding your estate plan should be one of your top priorities, and our Memphis, Tennessee estate planning lawyer can provide you with the guidance you need. The following are tips to consider to help prevent family conflict from occurring when the time comes:

Tip #1: Make Sure to Communicate Your Plans

While you certainly won’t want to share your estate plan with everyone you know, there are key people with you should make sure you communicate your plans to. This can help to manage expectations for when the time comes. These conversations can be incredibly challenging and even uncomfortable to have. You may also find that your loved ones are resistant to having it. However, by providing them with a clear outline of how your estate plan is divided, and the decisions you have made can give them the ability to ask questions and gain a clear understanding of the reasons behind your decision-making. It may even be beneficial to have one of your adult children be a part of the planning process.

Tip #2: Choose the Right Time and Place

Timing is everything when communicating your estate plans to loved ones. The last thing you should consider is bringing up such a delicate topic at a family event or holiday occasion. Make a plan to discuss your wishes at a time set aside to discuss your estate plan.

Tip #3: Don’t Set Your Children Up for Conflict

One of the biggest mistakes parents make is choosing one child to make decisions over their siblings’ inheritance. This could only lead to conflict amongst siblings, putting them in an incredibly challenging situation. This is why when it comes to estate planning, it is important to discuss all measures of it with one’s children, the factors that will come with the agreement, and more. This will help to avoid conflict among children.

Tip #4: Regularly Update Your Estate Plan

Updating your estate plan is critical for several reasons. People’s circumstances often change over time, meaning an estate plan is something that you should be sure to update or review at least every 3-5 years or experiencing one of these life changes:

- Divorce

- Marriage

- Birth/Adoption of Children

- Tax Updates

- Change in Assets

- Beneficiary Changes

Our estate planning lawyer in Memphis, TN, recommends that you update your estate regularly so that the plan you leave for your family is as clear and as accurate as possible.

Tip #5: Carefully Consider Whether to Disinherit Someone

You may find that there are some people you are looking to disinherit. While you will want to carefully consider whether this is appropriate, when it comes to close family, such as children, they must be aware of your wishes. Disinherited children may challenge your estate plan and are likely to create further conflict within the family. If you choose not to leave someone you love an inheritance because you are concerned that they are not responsible enough, consider speaking with our team about alternative ways you can manage this situation. A living trust may be another viable option.

Tip #6: Consider a Living Trust

A living trust can provide several benefits for estate planning. Creating a living trust allows you to place your assets into a trust while you are still living. You will have the ability to continue controlling the trust and making changes during your lifetime. Once you pass away, the appointed trustee assumes control of the trust. Living trusts outline your wishes and allow you to leave special instructions for how you would like assets distributed to heirs. Living trusts can be more difficult to challenge in court and can reduce conflict down the road.

To learn more about how Patterson Bray, can help you develop your estate plan, call our Memphis, TN estate planning lawyer to get started.

Common Myths About Estate Planning

Estate planning is an important yet confusing process. Many people don’t understand that much about the process and can make costly mistakes. With that being said, here are some common estate planning myths you shouldn’t believe.

- Estate planning is only for rich people. This is one of the biggest myths about estate planning. Just because you aren’t a millionaire, doesn’t mean that you can’t benefit from having a proper estate plan in place. Estate planning can ensure your loved ones are financially taken care of if you should die suddenly.

- Estate planning isn’t necessary for the young. Not enough young people make estate planning a priority. They assume that it can wait until they’re older. However, it’s important to remember that tomorrow is never promised. Life can be unpredictable at times. Even if you’re young and healthy right now, you should still consider creating an estate plan soon.

- Once you create an estate plan, that’s it. Setting up an estate plan is a solid step in protecting your family from the unexpected. However, keep in mind that you will likely need to update it multiple times throughout your life. Whenever you experience a major life change, like a divorce or birth of a child, you should have an estate planning lawyer in Memphis, TN review your estate plan.

- You should divide your assets evenly among your children. If you have multiple children, you might think it’s only fair to give them the same inheritances. However, this isn’t always the best idea. Your children may have very different needs and goals. For example, if one of your children isn’t as financially stable as the rest, you may decide to give him or her a bigger inheritance.

- You should always appoint a family member as an executor. Many people choose to appoint a close family member as the executor of their will. However, this might not be in your best interest. If you believe you believe there will be conflict among your family members, it may be better to appoint an impartial third-party, like a corporate trustee, as the executor.

- Hiring a lawyer isn’t necessary. Even if you think your estate plan is fairly simple, you should still consult a skilled estate planning lawyer. Wills can include complicated legal jargon and you don’t want to make costly mistakes. A lawyer can ensure your will states what you want it to.

Questions to Ask an Estate Planning Lawyer

If you want to establish an estate plan, it’s important to work with a skilled estate planning lawyer in Memphis, TN. He or she will help you create a valid plan that clearly states your wishes. Here are some questions you should ask an estate planning lawyer.

- Does your law firm specialize in estate planning? Some law firms may cover various areas of law. Ideally, you will want to work with a lawyer whose law firm primarily focuses on estate planning. Estate laws are constantly changing, and it’s important to work with a lawyer who keeps up with these changes. A lawyer who specializes in estate planning will also know how to properly word your documents to make them effective.

- How long will it take you to complete my estate plan? You’re likely curious about how long it will take to establish your estate plan, so don’t be afraid to ask your lawyer. Your lawyer should be able to give you a clear estimate. Generally, the simpler your estate plan is, the quicker it will take to finish.

- Will you send me estate planning documents to review? It doesn’t matter that you’re working with an experienced estate planning lawyer. It’s still important to look over these documents to make sure they state what you intend them to. If you notice any errors in the documents, you should inform your lawyer promptly.

- Do you handle periodic reviews? It’s necessary for most people to update their estate plans several times in their life. Whenever you experience a major life change, like the birth of a child or a divorce, you should review your estate plan. That’s why it’s important to work with an estate planning lawyer who conducts periodic reviews. Some lawyers will charge a small fee to review your estate plan.

- What are your fees? Before you make a hiring decision, you should find out about an estate planning lawyer’s fees. Some lawyers charge flat fees while others bill by the hour.

- What’s included in an estate plan? During your consultation, you should also ask the lawyer what’s included in an estate plan. Generally, a basic estate plan will include a living will, last will and testament, durable power of attorney, and health care power of attorney. If you have minor children, you may need to include a guardianship provision.

Estate Planning Lawyer Memphis TN

Finding the right estate planning lawyer in Memphis TN for you doesn’t have to be difficult if you know what you are looking for. That is where many people find themselves stuck. They don’t know what to look for in a lawyer and it can lead them on a wild goose chase of a hunt to find the one that works for them. Having a will and planning your finances ahead of time is vital and it simply ensures that there are no disagreements or issues that happen after death.

Having a plan ready is going to make everything easier. However, what do you even look for in a quality estate planning lawyer?

Qualities of a Good Estate Planning Lawyer

Regardless of when you start this journey, you need to know the qualities that you should look for when selecting one. Here are some of the traits a good estate planning lawyer should have.

-

Knowledge and Expertise

The truth is that you are going to want a lawyer that has the experience and knowledge to walk you through everything. A lawyer that is just starting out in this field most likely isn’t the best person for the job. That doesn’t mean that they aren’t good though. With every case that a lawyer goes through they gain experience to flourish in their careers. For you, this means they are better at handling your case.

Always ask your lawyer what their experience is like. If they are new to the field ask them who they mentor and what their experience is like. Never settle for the first lawyer you meet because they claim they understand your case.

-

Effective Communication

This is one of the most basic yet vital qualities any lawyer should have. Every aspect of the job requires the individual to communicate with others. If your lawyer can’t communicate efficiently then they likely aren’t the best for the job. The world of law is filled with complex terms and if you didn’t go to school for it, you may not know what it all means. A good lawyer is going to be able to explain it without complicating it further.

A good lawyer is going to be able to answer your questions and clear up any confusion that may happen. They are also going to be able to communicate with you easily if you need to talk to them about your case. Also, they won’t keep you waiting for days on an answer without any communication at all. If your lawyer ends up giving you radio silence for days then it is probably time to find a new one.

-

Empathy

Losing a loved one is hard and at the time of a loss estate planning probably isn’t on your to-do list. Chances are that you are probably stressed about everything to handle if you are named the executor of the estate of the deceased individual. Death is a hard topic to handle and if your lawyer isn’t meeting you with empathy, then they aren’t the right lawyer for you.

Your lawyer needs to be able to understand when to step in on your behalf and when to give you space. A quality lawyer is going to work with you, not against you during a difficult time. If you are someone who wants to do it themselves then a good lawyer will allow it and only step in when you need them.

-

Integrity

Legal proceedings can be very murky and unethical. That is just how the law of the land is laid out in many places. However, that doesn’t mean you should hire someone who is willing to do whatever it takes to get the job done, even if that means being unethical. Do your research on your lawyer to see if they have a history of resorting to dishonest means or if they have any disciplinary actions against them. You want someone with a clean record as judges tend to look down on lawyers who have actions were taken against them.

If you are looking for an estate planning lawyer in Memphis TN then consider the team here at Patterson Bray for your needs.

The Basics Behind a Will

A will is a way to convey your final wishes regarding the disposition of personal property and individual assets. It is a legally binding document that will likely need to go through a court process called probate. This court process ensures that things get done per your wants and desires as outlined in the will.

Requirements of a Will

For a will to be legal, it must contain certain things. First, you must appoint an executor. This is someone who you should either know very well and trust, such as a spouse or sibling, and who you know will be able to handle the duties of the position. The executor must be the liaison with the court and gather all necessary documents that are required under the probate process. The will must also be executed properly, in the presence of two unrelated witnesses.

What a Will Cannot Do

There are limitations to what can be accomplished in a will. If you are looking to do anything besides leave personal, singly owned property or assets to someone, you need to do it some other way. A will also cannot:

- Cannot pass on joint property

- Cannot put conditions on inheritance

- Cannot give money directly to someone without going through probate

- Cannot leave money to a pet

- Cannot disinherit a child

If you want to do anything listed above, you need to do so with other legal documents the estate planning attorney can help you create.

Other Ways To Pass Along Money

A will is not the only way you can leave something to heirs. Some accounts require you to name beneficiaries, such as life insurance policies, retirement accounts and trusts. These can be powerful tools in your estate planning arsenal.

Creating a will is the responsible thing to do so no one in your family has to go through a lengthier court process. Choose an estate planning lawyer who may provide you with the information required to make the best decision possible.

Please contact us today to speak with an Estate planning lawyer in Memphis, TN from Patterson Bray about planning for your future and legacy.

Leaving Funeral Instructions in a Will

As you and your Memphis, TN estate planning lawyer draw up a will, the topic of funeral preparations might arise. It is recommended you create a separate document that details your wishes for the funeral. This is because a will is typically not reviewed until after the funeral which means no one may even see your wishes until after it has already taken place. The document describing these wishes can be held by your estate planning lawyer or given to the executor of the estate.

What Should Not Be Included In A Will

Quick Tips About Last Will and Testaments

1. Wills do not allow you to avoid taxes. Wills are subject to estate taxes. If you wish to avoid large tax fees, you should talk to your lawyer about drawing up a trust.

2. Wills do go through probate. All wills are required to go through the probate process. Even if everything in the will is in good order, the process is not a swift one. There are ways to avoid probate. For example, you could put your assets in a trust fund. If you’re interested in this, please consult an estate planning lawyer.

3. Avoid arranging care for a person with special needs. A will is not the right place to detail the type of care you would like a person with special needs to have. Rather you should consider a special needs trust.

4. Do not leave your pets ‘gifts.’ Animals are not legally able to own assets. If you’re concerned about your pet, it is recommended to leave it with someone who can take good care of it. Depending on the state you are in, you may be able to name your pet as the beneficiary of a trust. If this makes you comfortable, you can talk to a Memphis, TN lawyer for further information.

Wills and Trusts

A will determines what happens to your assets after going through the probate process. A living trust can be set up in order to avoid that probate process and to reduce taxes that the estate would have to pay. Living trusts often offer more flexibility as far as determining which heirs will receive which assets.

Special needs trusts can also be set up for families who have disabled or special needs children who could lose financial aid if the asset were put directly in the child’s name.

Power of Attorneys

A Memphis estate planning lawyer can also assist you in drafting up legal documents that allow you to choose a power of attorney. This may be important in the event you become too ill or incapacitated to handle your own financial affairs.

Legal Guardianships

If you have minor children, it is important to designate someone as the legal guardian of your children. This person would oversee financial issues pertaining to your children’s wellbeing and may also handle any assets your children inherit from your estate. There are also other types of legal guardianship that an estate planning attorney can assist with, including those for disabled or elderly adults.

Advance Directives and Durable Health Care Power of Attorneys

Advance directives — also referred to as living wills — and durable health care power of attorneys (different from financial power of attorneys) are often drawn up together. These documents specifically express what your wishes are in the event you are nearing the end of life — either through an accident or illness — and that your wishes, not the wishes of loved ones, should be carried out.

Estate Tax Planning

Taxes are often very complicated and estate tax planning is no less complicated. An estate planning lawyer can discuss all of the different options you may have to help alleviate the tax obligations your estate assets may create.

Memphis Estate Planning Law Statistics

According to a survey conducted by Caring.com, more than 60 percent of Americans do not have wills drafted or any other estate planning tools in place. That comes out to two out of every three Americans.

Memphis Estate Planning Law FAQs

Few people welcome the idea of planning for a time when they are not going to be here. Looking for a Memphis, TN estate planning lawyer is probably not someone most people want to spend their free time doing.

The reality is, is no one is immortal. Everyone is going to eventually die and really, the only questionable factor is, when? We all hope that this is going to be a long way off and because of this, many people put off planning for what they want to happen to their estate when they are gone.

Why Get Help From an Estate Planning Lawyer?

Long-term care planning is part of the estate planning process. You may have worked hard for many years and would like your savings to provide you and your family with a good life. Perhaps you would like to pay for your grandchildren’s education or a round-the-world trip. If you fail to plan out your long-term care, you might risk losing money for the things you would like to do or give.

As you work with an Estate Planning Lawyer in Memphis, you might find that long-term care planning is one of the most challenging parts of the process. Part of the challenge comes from the very fact that you don’t know what will happen to you. For example, if your health declines, you may need to be placed in a nursing facility. On the other hand, you may be perfectly healthy until the day you die. Although it is difficult to predict what care you might need, if you do ever need it, the costs can be extremely high. The average cost of a standard nursing home facility in the U.S. is $6,000 – $8,000. This does not usually include treatment, surgery, or medications.

Regardless of your current state of health, it is inadvisable to ignore your long-term care considerations and planning. By organizing your long term care with an Estate Planning Lawyer in Tennessee, you can have a better chance at enjoying your retirement while also leaving a legacy to your heirs.

Why not plan your estate today?

Many of us put off estate planning because we have this nagging feeling that if we plan for what we want to happen to our belongings and assets when we are gone, we are inviting this to happen sooner. This is far from the truth.

The sooner you plan your estate the sooner you can relax knowing this is off of your shoulders. Many people experience a great sense of relief and calm when they know that the people and organizations they care about the most are going to get their belongings, whenever the time comes.

Finding a trustworthy Memphis, TN estate planning lawyer is a good first step towards gaining peace of mind in knowing that your estate is being taken care of in the way you want it to be.

What is a will?

A will often referred to as a “last will and testament,” is a document that lays out a person’s wishes for what they want to happen to their possessions after they die. It is read by a county court after a person dies and the court tries to ensure that their final wishes are carried out.

You can use a will to name an executor for your estate, name guardians for minor children and their property, lay out how you want debts and taxes to be paid, provide for pets, and to serve as a backup to a living trust.

Different states have different laws about wills and estates. Many people recommend enlisting the help of an experienced Memphis, TN estate planning lawyer that is licensed to practice in the jurisdiction where you live, to ensure that your will is valid and that your wishes are legally bound.

What should not be included in a will?

There are certain things that you should not include in your will. The following are only some. To learn about everything that can and cannot be included in a will, you can talk with a Memphis, TN estate planning lawyer.

1. Joint tenancy property. This is a special property that automatically gives your joint tenant the right to the property, regardless of what your will dictates.

2. Property listed in a living trust. If you don’t want your estate going through probate, you will need to set up a living trust with a lawyer. Any property that you list in a living trust cannot be included in a will. Furthermore, property in a living trust will automatically go to the beneficiaries. To change this, you’ll need to have your estate planning lawyer complete special forms. It cannot be done through a will.

3. Life insurance proceeds. If you have life insurance with a beneficiary, it will be given to that individual regardless of what is stated in a will.

4. Retirement plan proceeds. Any money from your retirement plans, such as a 401 (k), will go to the beneficiaries you listed within the respective forms to these plans.

What is trust?

A trust is a fiduciary arrangement where a third-party trustee, holds property as its nominal owner for the good of one or more beneficiaries. There are many different ways that trusts can be arranged that allow you to specify how and when assets pass on to your beneficiaries.

Why do people have a trust?

People have trusted for many different reasons but traditionally, people set them up to minimize estate taxes as well to give access to their beneficiaries more quickly than they might get assets that are transferred through a will.

You do not need to have a lot of money, assets, or property to benefit from a good estate planning lawyer’s help. Call a Memphis, TN estate planning lawyer today to take this off of your plate- it is time to start relaxing and enjoying your future, today.

What Can a Memphis Estate Planning Lawyer Do for Your Family?

Our lawyers may look at your unique situation to find out which estate planning tools will benefit your family. Factors such as your age, marital status, and whether you have minor or adult children are just some of the issues that play a part in estate planning.

What is a Living Trust?

A living trust, or trust, is a legal document that contains any assets that you place into it. The trust owns the property until you pass away, at which point your assets are transferred to your beneficiaries. If you are considering this option as part of your estate plan, the lawyers at Patterson Bray can help you finalize your trust.

What is the Difference Between a Will and a Living Trust?

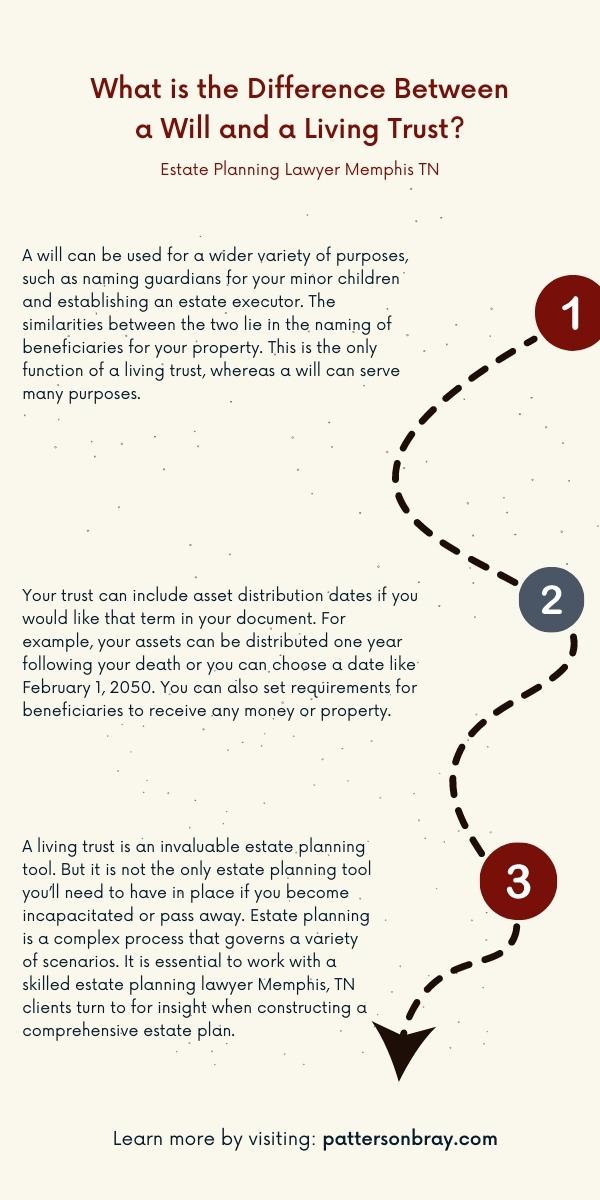

A will can be used for a wider variety of purposes, such as naming guardians for your minor children and establishing an estate executor. The similarities between the two lie in the naming of beneficiaries for your property. This is the only function of a living trust, whereas a will can serve many purposes. If you would like more clarification on the difference between these two legal documents, or guidance on which one is right for you, reach out to an estate planning lawyer in Memphis, TN.

Does Property in a Living Trust Go Through Probate?

No, assets distributed through a trust are not subject to probate. This is one of the main advantages of trust. Forgoing probate court can save your loved ones time and stress, which is why many people choose this option.

Can I Set Terms in my Trust?

Yes, you can. Your trust can include asset distribution dates if you would like that term in your document. For example, your assets can be distributed one year following your death or you can choose a date like February 1, 2050. You can also set requirements for beneficiaries to receive any money or property. If you want to ensure your grandchildren graduate college before they receive their inheritance, you can include that requirement. This ability to control the conditions is another common reason people choose to use a trust.

Can I Make Changes to my Trust?

Yes, you can amend, edit, or terminate your trust. If you would like to change the beneficiaries or adjust the terms of the trust, you can do so by working with an estate planning lawyer in Memphis, TN, to amend your document. It is recommended that you review all of your estate planning documents periodically.

Is a Living Trust the Best Choice?

There are advantages and disadvantages to all of your options. If you are unsure about the best choice for you, contact Patterson Bray.

What Other Documents Should I Include in My Estate Plan?

A living trust is an invaluable estate planning tool. But it is not the only estate planning tool you’ll need to have in place if you become incapacitated or pass away. Estate planning is a complex process that governs a variety of scenarios. It is essential to work with a skilled estate planning lawyer in Memphis, TN clients turn to for insight when constructing a comprehensive estate plan. Common documents included in an estate plan include a last will and testament, powers of attorney, and a living trust. However, there are a number of tools and documents you can include, so a lawyer can go over what will be recommended for your particular plan. They will guide you so that you have everything you want to include in your estate plan, and ensure that it will be executed properly.

Once the team at Patterson Bray, learns about your unique life experience, property, and preferences, we can help you create (or modify) a comprehensive estate plan. With these tools in place, your loved ones won’t need to second guess what your wishes are. Instead, they’ll be guided by clearly articulated, legally enforceable document.

What About Medicaid Planning?

Most older people, and families, will rely on Medicaid for long-term care. This is the only government-funded option available, and not every person will be eligible. In 2015, those who had less than $14,850 in countable assets would qualify for Medicaid. Many people misinterpret this rule and think that if they have more than this amount in assets, they have to pay for their long-term care. This is not true.

As a Tennessee Estate Planning Lawyer in Memphis might explain to you, you should not pay for healthcare that could be covered by Medicaid. That said, there are some assets that are exempt from the requirement limit. Those that are not covered may be included in trusts and gifting programs. Bare in mind that the rules for receiving Medicaid benefits are continuously changing.

Protecting your assets and wealth is far more than gifting assets or transferring them to a family member or a trust. In fact, with Medicaid, there is a look-back period. In general, if you’ve transferred assets in the last 5 or so years, you could be penalized. An Estate Planning Lawyer located in TN can help you to understand whether you are affected and how to navigate through the path of options.

Patterson Bray Memphis Estate Planning Lawyer

Memphis Estate Planning Lawyer Google Review

“My husband and I were in the market for an Estate Planning Attorney and came across Patterson Bray. Our experience could not have been better, extremely knowledgeable with regards to estate planning. I would highly recommend Patterson Bray!” – Rachael L.

Contact a Memphis Estate Planning Lawyer for Assistance

If you need to draw up estate planning documents, or you wish to update existing plans, contact a professional estate planning lawyer in Memphis TN today. The attorneys at Patterson Bray may take the time needed to discuss all your options and help determine what plans will benefit you and your family the most.

Call and make an appointment with a Memphis estate planning lawyer at 901-372-5003, or fill out a contact form on our website.

Client Review

“My husband and I were in the market for an Estate Planning Attorney and came across Patterson Bray. Our experience could not have been better. Lindsay Jones was extremely knowledgeable with regards to estate planning. I would highly recommend Patterson Bray!”

Rachael Lloyd